In early September, CHIR Assistant Analysis Professor Christine Monahan testified earlier than the Texas Home Insurance coverage Committee on outpatient facility price billing and potential reforms. The Texas legislature is presently making ready for its 89th legislative session subsequent spring, and the latest listening to will play a important function in shaping laws to return.

Christine’s feedback to the committee observe. A corresponding slide deck is obtainable right here.

At CHIR, we research non-public medical health insurance and well being care markets, conduct authorized and coverage evaluation, and supply technical help to federal and state policymakers, regulators and stakeholders on a spread of matters. With the assist of West Well being, I and several other members of the CHIR workforce have been finding out outpatient facility price billing for the previous two years. We’ve carried out a number of dozen interviews with on the bottom stakeholders, reviewed current legal guidelines and pending laws at each the state and federal ranges, written a number of analyses, and, most just lately, revealed a collection of maps reporting on our evaluation of the legal guidelines in all 50 states and the District of Columbia associated to outpatient facility price billing.

Step one to understanding facility price billing is to know that there are two forms of claims usually used to invoice for medical companies: an expert invoice (the CMS-1500) and the power invoice (the UB-04). If you happen to obtain care at an unbiased supplier observe, the supplier who handled you’ll submit an expert invoice to your insurer. This invoice, in concept, covers their time and labor in addition to any observe overhead prices, like nursing employees, lease, and tools and provides. However, in case you obtain care at a hospital outpatient division, typically talking any skilled who handled you, in addition to the hospital, will every submit separate payments. Any skilled payments ought to simply cowl the supplier’s time and labor, whereas the hospital invoice – or facility price – ostensibly covers overhead prices.

What counts as hospital overhead and what else goes right into a facility price is difficult, nevertheless. As you’ll count on, a facility price typically will cowl the overhead prices associated to the affected person go to for which it’s being billed, together with the nurses or assist employees concerned and any tools and provides. As a result of hospital outpatient departments want to fulfill further licensure and regulatory necessities, they seemingly even have some further prices that don’t apply to unbiased settings.

As well as, a facility price is more likely to cowl different hospital overhead prices. A few of these are mandatory and fascinating companies on the inhabitants degree, however not associated to the care delivered to the affected person who’s getting billed. For instance, facility charges may assist fund issues like hospital emergency companies, or 24/7 staffing and safety on the hospital, despite the fact that the affected person was on the facility throughout regular enterprise hours and didn’t want any emergency care or they went to a completely separate, off-campus facility ten miles from the hospital campus and emergency room. Hospital overhead prices may also embody issues of extra debatable worth – from excessive CEO salaries, to costly art work or connoisseur meals companies, to, I child you not, film manufacturing studios. All of these items could also be thought-about hospital “prices” that sufferers could be requested to pay by way of a facility price.

It’s also vital to know that different elements, unrelated to the price of care or different bills a hospital has, additionally play a giant function in figuring out how a lot a hospital payments for and will get paid by insurers, together with historic billing patterns and market energy. Significantly as hospitals and well being techniques get larger, and vertically combine, they’ve rather more energy than your solo doctor or unbiased group observe to demand larger reimbursement when negotiating with insurers.

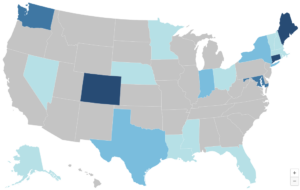

So, when financial specialists examine the costs paid for a similar companies at hospital outpatient departments and unbiased doctor places of work, they discover a lot larger costs in hospital settings. Chemotherapy is one instance from the Committee for a Accountable Federal Price range. A affected person going for weekly chemotherapy visits would see, on common, a 2.7-fold distinction in worth in the event that they switched from an unbiased observe to a hospital outpatient division. And, in fact, they’re typically not those making that alternative to change – slightly, in the future in the course of remedy they might go into the identical workplace constructing as all the time, for a similar care as all the time, and are available away with a invoice that’s greater than $400 larger than what they’re used to as a result of a hospital acquired their observe and transformed it to a hospital outpatient division.

It’s this latest historical past of aggressive hospital acquisition of outpatient practices that’s driving the difficulty as we speak. Facility price billing isn’t a novel observe, however it’s extra widespread than it was once following years of vertical integration the place hospitals are buying or constructing their very own outpatient doctor practices and clinics. Certainly, one of many causes hospitals and well being techniques have considerably expanded their possession and management over outpatient doctor practices over the previous decade or so, is so they may cost this second invoice and improve their revenues.

One other seemingly motive we’re listening to about facility price billing extra now are inadequacies in insurance coverage protection. Because the hospital trade will emphasize, sufferers more and more are coming in with excessive deductible well being plans which go away them uncovered to extra prices, together with facility charges. The hospitals aren’t flawed in stating this hole, however it’s best understood as a symptom of the higher downside of rising costs.

Increased spending on outpatient care from facility price prices is rising the price of medical health insurance for all of us: sufferers and customers who enroll in medical health insurance, employers who’re sponsoring insurance coverage for his or her employees and paying greater than 70-80% of their well being plan premiums, and taxpayers who closely subsidize the non-public medical health insurance market. Economist Stephen Parente, who served on the White Home Council of Financial Advisers within the Trump Administration, just lately launched a research discovering that employer plan premiums may go down greater than 5% yearly if insurers paid the identical quantity for care in a hospital outpatient division as they do an unbiased doctor’s workplace. This in flip would lead to $140 billion in financial savings to the federal authorities over ten years by way of lowered tax subsidies for employer plans. Whereas not the one issue, outpatient facility price billing is contributing to the rising unaffordability of medical health insurance as we speak.

On the identical time, insurers are responding to those worth will increase largely by rising cost-sharing and in any other case limiting advantages. Because the hospital trade factors out, medical health insurance deductibles are rising in measurement and prevalence. Lots of these $200, $300, $400+ facility charges are going straight to the affected person. Customers can also face larger cost-sharing for care offered at a hospital outpatient division even when their deductible doesn’t apply. This may be as a result of the power price is carrying its personal distinct cost-sharing obligation from the skilled invoice or as a result of insurers set larger cost-sharing charges for companies offered at hospital outpatient departments to attempt to discourage sufferers from going to them. Moreover, some insurers could merely not cowl a service when it’s offered at a hospital outpatient division, in an effort to comprise their very own spending whereas doubtlessly opening up sufferers to steadiness billing.

In sum, inadequacies in insurance coverage protection are enjoying a task in exposing customers to excessive medical payments which is driving media consideration. But when insurance coverage coated these prices with none cost-sharing, customers in addition to employers and taxpayers would nonetheless be paying for it by way of their premium {dollars} – it simply can be much less seen.

What, then, could be executed to deal with these issues? One possibility is to proceed to attend to see if the non-public market will repair it. However there are boundaries to non-public reforms, together with a lack of understanding, an absence of leverage, and an absence of motivation.

With respect to data, one of many refrains we constantly hear from stakeholders is that there are vital gaps in claims information that make it difficult for personal payers and regulators alike to know the complete scope and affect of facility price billing. Particularly, they reported that it may be very tough if not unattainable to establish the precise brick and mortar location the place care was offered on a claims type or in a claims database. The deal with line may check with the principle campus of a hospital that owns the observe, and even an out-of-state billing workplace for the well being system.

By way of leverage, dominant hospitals often have the upper-hand in negotiations with insurance coverage corporations as a key promoting level for insurers is that they’ve the identify model hospital or doctor group of their community. In Massachusetts, one of many main insurers proactively sought to remove outpatient facility price billing by in-network suppliers, however may solely do that in a finances impartial method (agreeing to lift charges elsewhere to make up the distinction) and nonetheless one main well being system has refused to play ball and continues to invoice facility charges as we speak. Reforms like prohibiting anticompetitive contracting clauses, as Texas has enacted, could start to chip away at elements contributing to hospitals’ dominance in negotiations nevertheless.

Relating to motivation, insurers typically don’t profit from reducing well being care prices as they take house a share of spending. However public scrutiny on egregious facility charges in Massachusetts motivated the insurer I beforehand talked about to behave, and will encourage different insurers elsewhere to observe go well with. Moreover, massive employers more and more are partaking on this and different well being care spending points, and they can stress insurers to remove facility price billing of their contracts with suppliers. Certainly, I do know of at the least two state worker well being plans which have executed so.

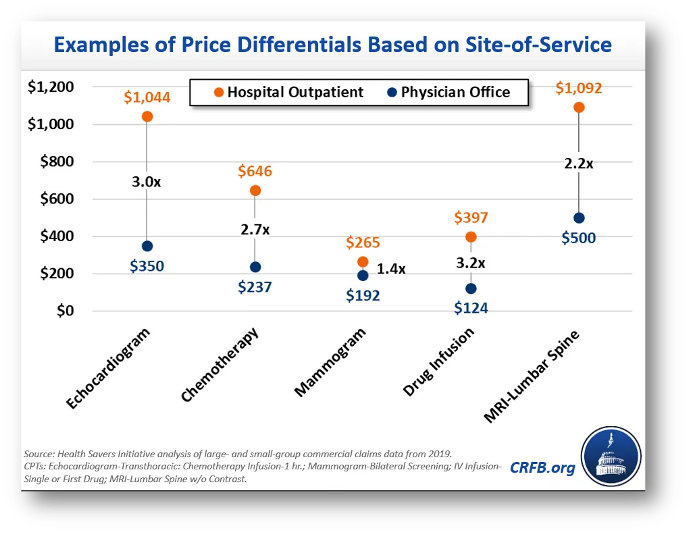

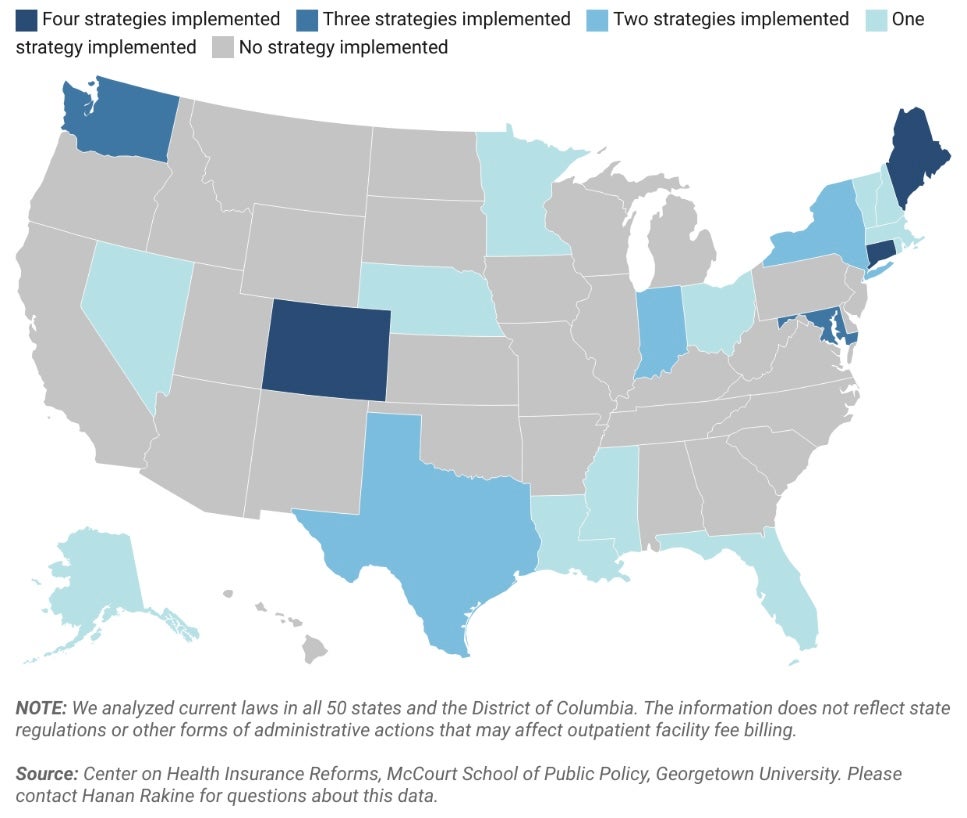

Finally, although, facility price billing and different aggressive hospital pricing and billing practices are an uphill battle for the non-public market to sort out alone. Accordingly, we’re seeing states throughout the nation, reflecting broad geographic and political range, start to pursue legislative reforms. By our depend, twenty states nationwide have enacted a number of of the six potential options our workforce has recognized: web site impartial cost reforms, facility price billing bans, billing transparency necessities, public reporting necessities, cost-sharing protections, and shopper notification necessities. I’m going to deal with simply the primary three I discussed proper now, however we’ve got further data on others and I’m comfortable to debate any of them. Importantly, none of those reforms are mutually unique. They merely sort out the problems from completely different, however complementary angles.

First, states are starting to sort out the transparency points I simply raised. Notably Colorado, Nebraska, and Nevada now require off-campus hospital outpatient departments to accumulate a singular, location-specific supplier identifier quantity – generally known as an NPI – and embody it on claims kinds. It is a easy and minimally burdensome reform that might significantly improve claims information. As Colorado has realized, pairing this information with a system for monitoring which NPI belongs to which well being system could make it much more helpful, as it could give visibility into each the placement of care and who owns that setting. This data may assist non-public payers or regulators and policymakers rein in outpatient facility price billing. It additionally could possibly be priceless in serving to payers undertake tiered supplier networks or in any other case steer sufferers in the direction of or away from completely different supplier places based mostly on the standard or price of care they supply.

A state in search of to go additional than that would prohibit hospital outpatient departments from charging facility charges for specified companies. Texas, in fact, has already executed this very narrowly for companies like Covid-19 assessments and vaccinations when carried out at drive-through clinics at free-standing emergency departments. States like Connecticut, Maine, and Indiana, nevertheless, have extra broadly prohibited hospitals and well being techniques from charging facility charges for outpatient analysis and administration companies or different office-based care in sure settings.

By prohibiting facility charges for specified companies, policymakers shield sufferers from doubtlessly bearing the cost-sharing brunt of two payments. For instance, slightly than owing a $30 copay on the doctor’s invoice and a 40% coinsurance cost on the power price, the affected person will return to owing only a $30 copay, as if that they had obtained care in an unbiased setting. For the big share of the inhabitants who wouldn’t have sufficient money to pay typical non-public plan cost-sharing quantities, it is a actually huge deal. On the identical time, the system-wide financial savings from such a reform seemingly will likely be comparatively muted in the long term, as market highly effective hospitals renegotiate their contracts and improve different costs to make up for the lack of income from facility charges, as we noticed occur in Massachusetts.

Lastly, policymakers who’re feeling significantly bold could wish to contemplate site-neutral cost reforms, which is what Stephen Parente was finding out. These reforms name for insurers to pay the identical quantity for a similar service, no matter whether or not the service was offered at a hospital outpatient division or an unbiased observe.

How this works, and the way huge of an impact it could have, depend upon quite a lot of design selections. As with facility price bans, one of many important selections will likely be what companies are coated and this could possibly be broad or slim. Simply as vital is who determines how a lot insurers pay for a service and the way this cost degree compares to current costs. Below probably the most hands-off model of a site-neutral coverage, lawmakers may merely require that insurers undertake site-neutral funds with out specifying a cost degree and leaving that to non-public market negotiations. Alternatively, lawmakers may establish, or job regulators with figuring out, a benchmark degree be it tied to current business charges or a public price schedule, comparable to a share of Medicare. The extra companies coated and the decrease the cost degree, the higher the financial savings.

No state at this level has enacted a site-neutral coverage within the business sector to this point, however there may be rising curiosity and I anticipate that we are going to see some site-neutral payments launched within the coming yr.

Thanks for having me.